Duparquet Project

- Project Overview

- Technical Reports

Project Overview:

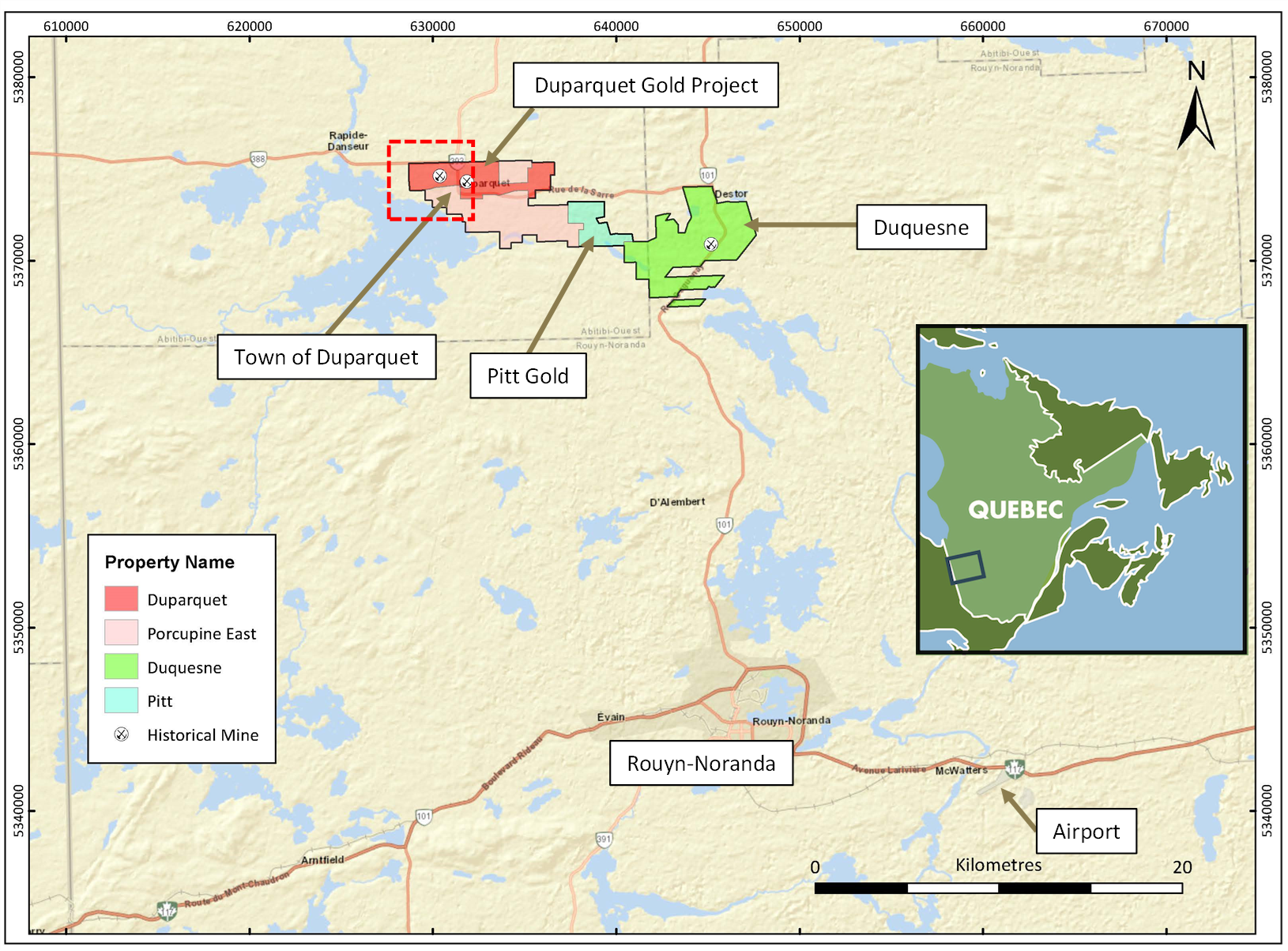

The Duparquet Gold Project, located on the Destor-Porcupine Fault Zone in the Abitibi region of Quebec, Canada, is one of the largest undeveloped gold projects in North America. The Project is located immediately north of the town of Duparquet which is approximately 50 kilometres northwest of Rouyn-Noranda, Quebec, a major mining service centre and home to the only remaining copper smelter in Canada. Duparquet currently hosts 3.4 million ounces of gold in the Indicated Mineral Resource category and 2.6 million ounces of gold in the Inferred Mineral Resource category. The deposits and claim blocks that comprise of the project are:

- Duparquet Deposit, which consists of the following claim groups:

- Beattie

- Donchester

- Dumico

- Central Duparquet

- Duquesne Deposit

- Pitt Gold Deposit

- Porcupine East Property

On September 7, 2023, First Mining announced results of a Preliminary Economic Assessment at the Duparquet Gold Project (see news release)

Map showing First Mining’s land tenure in Quebec

Duparquet Gold Project - Mineral Resources:

Duparquet Deposit Mineral Resource Estimate (Effective September 12, 2022)

| Area (mining method) |

Cut-off (g/t) |

Measured resource | Indicated resource | Inferred resource | ||||||

| Tonnage (t) | Au (g/t) |

Ounces | Tonnage (t) | Au (g/t) |

Ounces | Tonnage (t) | Au (g/t) |

Ounces | ||

| Potential Open Pit |

0.40 | 163,700 | 1.37 | 7,200 | 59,410,600 | 1.52 | 2,909,600 | 28,333,000 | 1.07 | 970,400 |

| Potential UG Mining |

1.50 | - | - | - | 5,506,900 | 2.26 | 399,300 | 9,038,900 | 2.29 | 665,600 |

| Tailings | 0.40 | 19,900 | 2.03 | 1,300 | 4,105,200 | 0.93 | 123,200 | - | - | - |

| Total | 183,600 | 1.43 | 8,500 | 69,022,700 | 1.55 | 3,432,100 | 37,371,900 | 1.36 | 1,636,000 | |

Pitt Gold and Duquesne Deposits Mineral Resource Estimate (Effective September 15, 2023)

| Area (mining method) |

Cut-off (g/t) |

Pitt Gold Inferred Resource | Duquesne Inferred resource | ||||

| Tonnage (t) | Au (g/t) |

Ounces | Tonnage (t) | Au (g/t) |

Ounces | ||

| Potential Open Pit |

0.50 | - | - | - | 6,300,000 | 1.56 | 316,000 |

| Potential UG Mining |

1.75 | 2,120,000 | 2.67 | 187,200 | 5,030,000 | 3.10 | 501,400 |

| Total | 2,120,000 | 2.67 | 187,200 | 11,330,000 | 2.24 | 817,400 | |

Duparquet Gold Project Consolidated Mineral Resource Estimate (Effective September 15, 2023)*

| Area | Total Measured Resource | Total Indicated Resource | Total Inferred Resource | ||||||

| (mining method) | Tonnage (t) | Au | Ounces | Tonnage (t) | Au | Ounces | Tonnage (t) | Au | Ounces |

| (g/t) | (g/t) | (g/t) | |||||||

| Potential Open Pit |

163,700 | 1.37 | 7,200 | 59,410,600 | 1.52 | 2,909,600 | 34,633,000 | 1.16 | 1,286,400 |

| Potential UG Mining |

- | - | - | 5,506,900 | 2.26 | 399,300 | 16,189,000 | 2.60 | 1,354,100 |

| Tailings | 19,900 | 2.03 | 1,300 | 4,105,200 | 0.93 | 123,200 | - | - | - |

| Total | 183,600 | 1.43 | 8,500 | 69,022,700 | 1.55 | 3,432,100 | 50,822,000 | 1.62 | 2,640,500 |

Notes to accompany the Duparquet Gold Project Mineral Resource Estimates:

- 1. The independent qualified persons for the Duparquet mineral resource estimate, as defined by NI 43-101, are Marina Iund, P.Geo., Carl Pelletier, P.Geo. and Simon Boudreau, P.Eng. from InnovExplo. The effective date of the estimate is September 12, 2022.

- 2. The independent qualified persons for the Pitt Gold and Duquesne mineral resource estimates, as defined by NI 43 101, are Olivier Vadnais-Leblanc, P.Geo., Carl Pelletier, P.Geo., and Simon Boudreau, P.Eng. from InnovExplo. The effective date of the estimate is August 31, 2023.

- 3. Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to a Measured and Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. The mineral resource estimate follows current CIM Definition Standards

- 4. The results are presented in situ and undiluted and have reasonable prospects of eventual economical extraction.

- 5. In-pit and Underground estimates encompass sixty (60) mineralized domains and one dilution envelop using the grade of the adjacent material when assayed or a value of zero when not assayed; The tailings estimate encompass four (4) zones.

- 6. Duparquet: In-pit and Underground: High-grade capping of 25 g/t Au; Tailings: High-grade capping of 13.0 g/t Au for Zone 1, 3.5 g/t Au for Zone 2, 1.7 g/t Au for Zone 3 and 2.2 g/t Au for Zone 4. High-grade capping supported by statistical analysis was done on raw assay data before compositing.

- 7. Pitt Gold: Underground: High-grade capping of 20 g/t Au. High-grade capping supported by statistical analysis was done on composited assays.

- 8. Duquesne: In-pit and Underground: High-grade capping of 55 g/t Au. High-grade capping supported by statistical analysis was done on composited assays.

- 9. In-pit and Underground: For Duparquet, the estimate used a sub-block model in GEOVIA SURPAC 2021 with a unit block size of 5m x 5m x 5m and a minimum block size of 1.25m x 1.25m x1.25m. For Pitt Gold and Duquesne, the estimates used a sub-block model in GEOVIA SURPAC 2023 with a unit block size of 6m x 6m x 6m and a minimum block size of 1.5m x 0.5m x0.5m. Grade interpolations were obtained by ID2 using hard boundaries. Duparquet Tailings: The estimate used a block model in GEOVIA GEMS with a block size of 5m x 5m x 1m. Grade interpolation was obtained by ID2 using hard boundaries.

- 10. In-pit and Underground: For Duparquet, a density value of 2.73 g/cm3 was used for the mineralized domains and the envelope. For Pitt Gold and Duquesne, a density value of 2.7 g/cm3 was used for the mineralized domains and the envelope. A density value of 2.00 g/cm3 was used for the overburden. A density value of 1.00 g/cm3 was used for the excavation solids (drifts and stopes) assumed to be filled with water. Tailings: A fixed density of 1.45 g/cm3 was used in zones and waste.

- 11. In-pit and Underground: For Duparquet, the mineral resource estimate is classified as Measured, Indicated and Inferred. The measured category is defined by blocks having a volume of at least 25% within an envelope built at a distance of 10 m around existing channel samples. The Indicated category is defined by blocks meeting at least one (1) of the following conditions: Blocks falling within a 15-m buffer surrounding existing stopes and/or blocks for which the average distance to composites is less than 45 m. A clipping polygon was generated to constrain Indicated resources for each of the sixty (60) mineralized domains. Only the blocks for which reasonable geological and grade continuity have been demonstrated were selected. All remaining interpolated blocks were classified as Inferred resources. Blocks interpolated in the envelope were all classified as Inferred resources. Tailings: The Measured and Indicated categories were defined based on the drill hole spacing (Measured: Zones 1 and 2 = 30m x 30m grid; Indicated: Zone 3 = 100m x 100m grid and Zone 4 = 200m x 200m grid). For Pitt Gold and Duquesne, the mineral resource estimate are completely classified as Inferred due to a lack of confidence in certain drill hole collar and underground development locations.

- 12. The Mineral Resource Estimate for Duquesne and Pitt Gold was prepared using 3D block modelling and the inverse distance squared ("ID2") interpolation method.

- 13. The mineral resources are categorized as Inferred based on drill spacing, as well as geological and grade continuity. A maximum distance to the closest composite of 75 m for Inferred in all zones for Duquesne of 210 m for Inferred in all zones for Pitt Gold.

- 14. The reasonable prospect for an eventual economical extraction is met by having used reasonable cut-off grades both for a potential open pit and underground extraction scenarios (minimum mining width of 2m) and constraining volumes (Deswik optimized shapes and Whittle optimized pit-shells).

- 15. In-pit and Underground: The mineral resource estimate is locally pit-constrained with a bedrock slope angle of 50° and an overburden slope angle of 30°. The out-pit mineral resource met the reasonable prospect for eventual economic extraction by having constraining volumes applied to any blocks (potential underground extraction scenario) using DSO. Duparquet resources is reported at a rounded cut-off grade of 0.4 g/t Au (in-pit and tailings) and 1.5 g/t Au (UG). The cut-off grades were calculated using the following parameters: mining cost = CA$70.00 (UG); processing cost = CA$11.9 (tailing) to CA$17.0 (pit& UG); G&A = CA$8.75; refining and selling costs = CA$ 5.00; gold price = US$ 1,650/oz; USD:CAD exchange rate = 1.31; and mill recovery = 93.9%. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.). Duquesne resources are reported at a rounded cut-off grade of 0.5 g/t Au (in-pit) and Pitt Gold and Duquesne resources are reported at a rounded cut-off grade of 1.75 g/t Au (UG). The cut-off grades were calculated using the following parameters: mining cost = CA$84.86 (UG); processing cost = CA$21.010; G&A = CA$11.75; refining and selling costs = CA$ 5.00; gold price = US$ 1,800/oz; USD:CAD exchange rate = 1.3; and mill recovery = 90%. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

- 16. The number of metric tons was rounded to the nearest thousand and ounces were rounded to the nearest hundred, following the recommendations in NI 43 101. Any discrepancies in the totals are due to rounding effects.

- 17. The PEA is preliminary in nature, that it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

- 18. The qualified persons are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, or marketing issues, or any other relevant issue not reported herein, that could materially affect the Mineral Resource Estimate.