Springpole Project

- Project Overview

- Environmental Assessments & Permitting

- Technical Reports

- Video and Photo Gallery

- Newsletter

Project Overview:

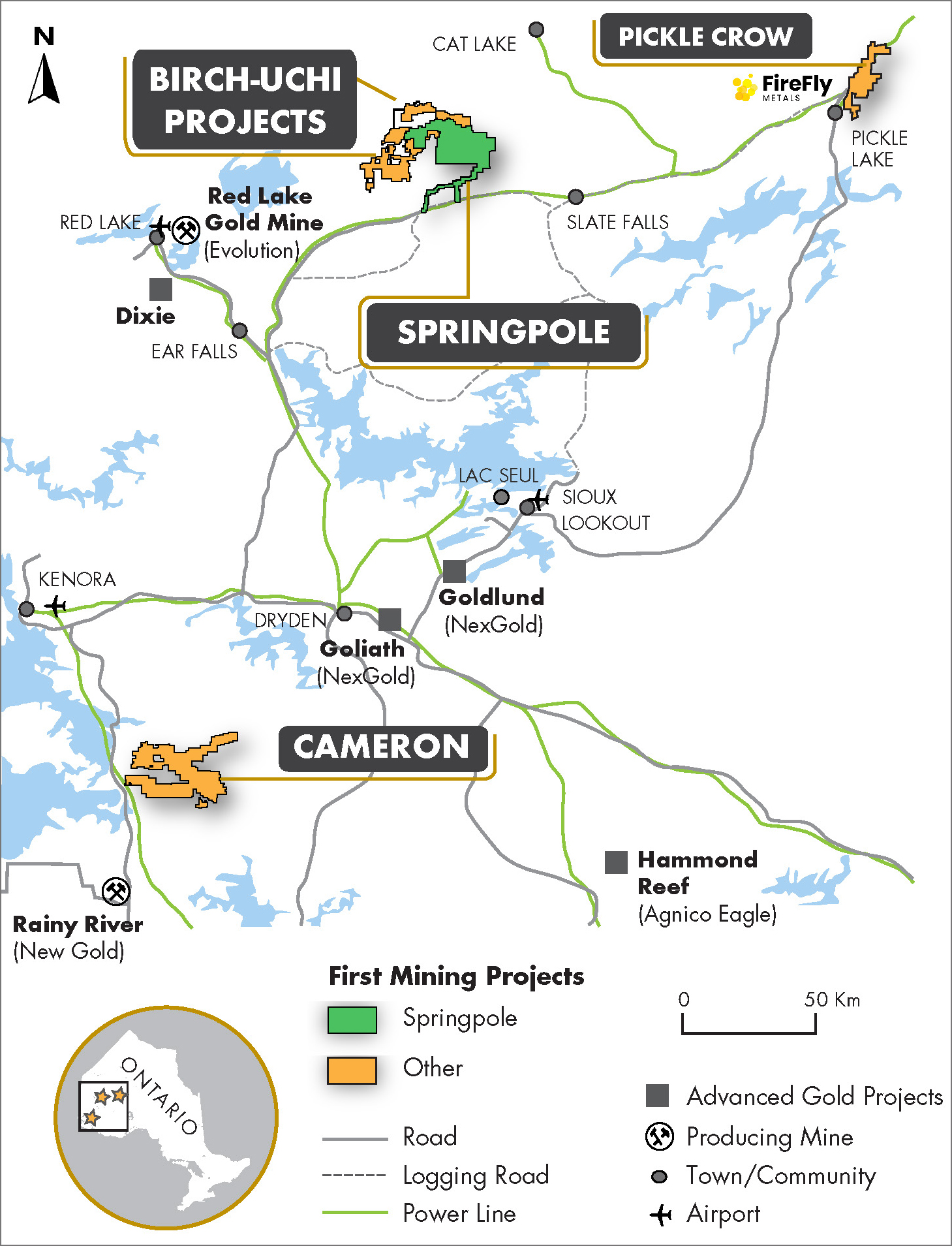

The Springpole Gold Project is located in northwestern Ontario on an area of approximately 800 hectares. The broader project land package covers an area of 41,943 hectares and consists of 30 patented mining claims, 282 mining claims and thirteen mining leases. The project is located approximately 110 kilometres northeast of the Municipality of Red Lake in northwestern Ontario and is situated within the Birch-Uchi Greenstone Belt. The large, open pit resource is supported by significant infrastructure, including an onsite camp, winter road access, a logging road within 18 km of the camp, and nearby power lines within 40 km.

With 151 Mt at 0.94 g/t Au and 5.0 g/t Ag, totalling 4.6 million ounces of gold and 24.3 million ounces of silver in the Indicated Mineral Resource category, and 16 Mt at 0.54 g/t Au and 2.8 g/t Ag, totalling 0.3 million ounces of gold and 1.4 million ounces of silver in the Inferred Mineral Resource category, the Springpole Gold Project is one of the largest undeveloped gold projects in Ontario.

Birch Uchi Greenstone Belt Project:

The Birch-Uchi Greenstone Belt Project (“BUGB Project”) represents regional scale exploration opportunities that have been consolidated by First Mining surrounding the Springpole Project. This land tenure coupled with the Springpole Project, also located in the Birch-Uchi Greenstone Belt, consists of >70,000 hectares and presents a strong opportunity for new discoveries in an area that is historically underexplored and has only seen a fraction of the exploration work that has been done in the neighbouring Red Lake and Pickle Lake greenstone belts that have been subject to earlier consolidation and discovery cycles.

The BUGB Project hosts significant geologic elements, including historic production centres that are demonstrative of a strong gold endowment and affinity for new discovery. First Mining’s extensive BUGB property position is located within the Red Lake Mining District and is situated approximately 80 km east of the Red Lake Mines Complex of Evolution Mining and 75 km northeast of Kinross Gold’s Dixie Project (formerly owned by Great Bear Resources Ltd). The geology of the region is comprised of Archean Greenstone terranes that are endowed by significant gold mineralization inclusive of orogenic and alkaline intrusion related deposit styles. Initial data compilation and validation to date has indicated that the region demonstrates an underexplored and previously fragmented exploration immaturity that is well levered to the Company’s strategy of consolidation and district screening.

First Mining has initiated district-scale screening of the Birch-Uchi Project area through a multi-phase commitment to explore and enhance mineral potential within the region.

Project Highlights:

- One of the largest, undeveloped, open-pit gold deposits in Canada

- Reserves of 3.8 million ounces gold at 0.97 g/t, 20.5 million ounces of silver at 5.2 g/t

- Average annual gold production of 335,000 ounces in years 1 through 9

- Positive Economics, +11 year mine life

- PFS announced January 2021, post-tax NPV5% of $995 million and post-tax IRR of 29%

- Tier 1 Mining Jurisdiction

- Long history of gold production in the area

- Unique Strategic Gold Asset

- One of the few projects in Canada able to produce more than 300,000 oz per year

- Existing Infrastructure in Place

- 34-person exploration camp, winter road access, a logging road within 18 km of the camp, and nearby power lines within 40 km

2021 Pre-Feasibility Study (PFS) Highlights1):

The PFS contemplates an open pit mine and milling operation, evaluating recovery of gold and silver from a 30,000 tonne-per-day operation, with a process plant that includes crushing, grinding and flotation, with fine grinding of the flotation concentrate and agitated leaching of both the flotation concentrate and the flotation tails followed by a carbon-in-pulp recovery process to produce doré bullion.

The PFS report, entitled “NI 43-101 Technical Report and Pre-Feasibility Study on the Springpole Gold Project, Ontario, Canada” was prepared by AGP Mining Consultants Inc. (“AGP”) in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and has an effective date of January 20, 2021.

View the report here

Key PFS highlights include:

- US$1.5 billion pre-tax net present value at a 5% discount rate (“NPV5%”) at US$1,600/oz gold (“Au”), increasing to US$1.9 billion at US$1,800/oz Au

- US$995 million after-tax NPV5% at US$1,600/oz Au, increasing to US$1.3 billion at US$1,800/oz Au

- 36.4% pre-tax internal rate of return (“IRR”); 29.4% after-tax IRR at US$1600/oz Au

- Life of mine (“LOM”) of 11.3 years, with primary mining and processing during the first 9 years and processing lower grade stockpiles for the balance of the mine life

- After-tax payback of 2.4 years

- Declaration of Mineral Reserves: Proven and Probable Reserves of 3.8 Moz Au, 20.5 Moz Ag (121.6 Mt at 0.97 g/t Au, 5.23 g/t Ag)

- LOM metal recovered 3.2 Moz Au, 18.1 Moz Ag; 3.0 Moz Au (LOM), 16.1 Moz Ag (Years 1 to 9)

- Initial capital costs estimated at US$718 million; Sustaining capital costs at US$55 million; plus another US$29 million in closure costs

- Annual payable gold production of 335 koz (Years 1 to 9); 287 koz (LOM)

- Low strip ratio of 2.22 to 1 (Years 1 to 9); 2.36 to 1 (LOM)

- Mill head grade of 1.12 g/t Au and 5.7 g/t Ag (Years 1 to 9); 0.97 g/t Au and 5.2 g/t Ag (LOM)

- Overall recoveries of 87% for gold and 90% for silver (Years 1 to 9); and 86% for gold and 90% for silver (LOM)

- Total cash costs of US$558/oz (Years 1 to 9); and US$618/oz (LOM) (1)

- All-in sustaining costs (“AISC”) of US$577/oz (Years 1 to 9), and AISC US$645 (LOM) (2)

Note: Base case parameters assume a gold price of $1,600/oz and a silver price of $20/oz, and an exchange rate (C$ to US$) of 0.75. All currencies are reported in U.S. dollars unless otherwise specified. NPV calculated as of the commencement of construction and excludes all pre-construction costs.

(1) Cash costs consist of mining costs, processing costs, mine-level G&A, treatment and refining charges and royalties.

(2) AISC consists of cash costs plus sustaining and closure costs.

Springpole Mineral Resources (inclusive of Mineral Reserves)

|

Category

|

Tonnes (Mt)

|

Grade

Au (g/t) |

Grade

Ag (g/t) |

Contained Metal

Au (Moz) |

Contained Metal

Ag (Moz) |

|

Indicated

|

151

|

0.94

|

5.0

|

4.6

|

24.3

|

|

Inferred

|

16

|

0.54

|

2.8

|

0.3

|

1.4

|

Notes:

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability;

- All figures are rounded to reflect the relative accuracy of the estimate. All composites have been capped where appropriate;

- Mineral Resources potentially amenable to open pit mining are reported within an optimized constraining shell using the following parameters:

- Metal prices of USS 1550 /oz gold, US$ 20/ oz silver, exchange rate of 0.77 USD:CAD

- Mining cost of CAD$ 1.62 /t, processing cost of CAD$ 15.38 /t milled, G&A of CAD$ 1.00 /t milled

- Pit slopes varying between 35 and 50 degrees depending on domain

- Gold recovery of 88% and silver recovery of 93%

- Mineral Resources are reported at a COG of 0.3 g/t gold.

The Mineral Reserves for Springpole are based on the conversion of Measured and Indicated resources within the current Springpole PFS pit design. The Springpole Gold Project Mineral Reserves are shown below:

Springpole Mineral Reserves

|

Category

|

Tonnes

(Mt) |

Grade

Au (g/t) |

Grade

Ag (g/t) |

Contained Metal

Au (Moz) |

Contained Metal

Ag (Moz) |

|

Proven

|

0.0

|

0.0

|

0.0

|

0.0

|

0.0

|

|

Probable

|

121.6

|

0.97

|

5.23

|

3.8

|

20.5

|

|

Total

|

121.6

|

0.97

|

5.23

|

3.8

|

20.5

|

Notes:

- This mineral reserve estimate has an effective date of December 30, 2020 and is based on the Mineral Resource estimate that has an effective date of July 30, 2020.

- The mineral reserve estimate was completed under the supervision of Gordon Zurowski, P.Eng., of AGP Mining Consultants Inc., who is a Qualified Person as defined under NI 43-101.

- Mineral reserves are stated within the final design pit based on a US$878/ounce gold price pit shell with a US$1,350 /ounce gold price for revenue.

- The equivalent cut-off grade was 0.34 g/t Au for all pit phases.

- The mining cost averaged CAD$ 2.75/tonne mined, processing cost averages CAD$ 14.50/tonne milled, and G&A cost averaged CAD$ 1.06/tonne milled. The process recovery for gold averaged 88% and the silver recovery was 93%. The exchange rate assumption applied was CAD$1.30 equal to US$1.00.

- Indicated Mineral Resources in the mine plan were converted directly to Probable Mineral Reserves. There are currently no estimated Measured Mineral Resources and therefore there are no Proven Mineral Reserves.

Follow the link to our Environmental Assessment Portal for up to date detailed information regarding the permitting and engagement programs related to our Springpole Project.

Please visit our ESG section for our Springpole Explorer newsletter HERE.